Trends and ControversiesCheck out the other feature articles in this month's issue: - Myopia: Should We Treat It Like a Disease? |

COVID-19 is not an extinction event for optometry, but that does not diminish its stressful and humbling effects. The post-COVID-19 landscape is bound to change many facets of eye care, including consumer behavior, business strategy and practice operation. What follows is a view into each of these windows of what may lie ahead.

Online Product Sales Get Turbo-Charged

A lot of practices reopened following the COVID-19 shutdown to find accumulated prescription verification faxes from online contact lens retailers. During the closures earlier this year, more consumers purchased goods online, including eyeglasses and contact lenses.

During the height of the COVID-19 shutdown, 1-800-CONTACTS reported a 100% year-over-year increase in new and returning customers.1 Concurrently, the company’s ExpressExam app saw a 200% increase in use, while its Rx Reader app saw a 700% increase in monthly active users.1

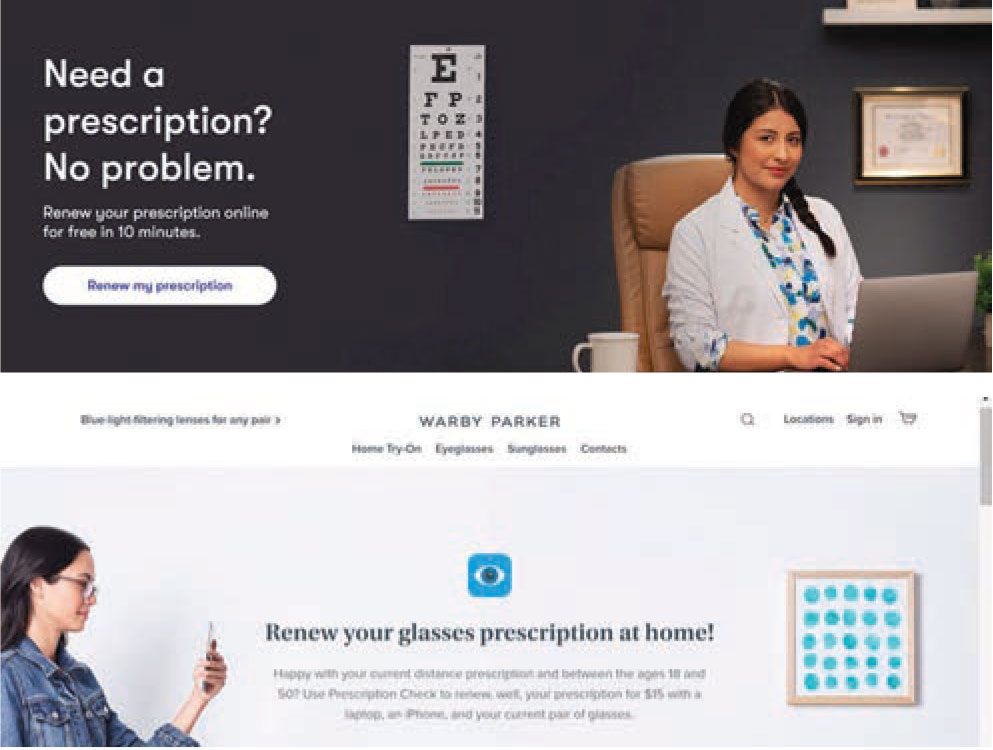

Along the same lines, other major online eye care retailers in addition to 1-800-CONTACTS, such as Warby Parker and GlassesUSA, stepped up promotion of their prescription renewal services (Figure 1). Their ability to duplicate old prescriptions allows them to bypass a doctor-generated prescription, the major constraint to selling their products.

GlassesUSA and 1-800-CONTACTS have apps that offer smartphone lensometry for single vision lenses with a spherical power between -6.00D and +3.00D and cylinder up to -2.50D (Figure 2). Using this service, shoppers can buy glasses without a valid prescription. While GlassesUSA’s Prescription Scanner app’s terms of use state that it should only be used if the user is free of eye disease and 18 to 45 years old and the prescription is valid and newer than 24 months, this is not enforced.

Online prescription renewal appeals to consumers who want to obtain glasses or contact lenses without undergoing a comprehensive eye examination whether due to perceived inconvenience, cost or risk of contracting illness. Optometrists can expect these technologies to improve in simplicity, speed and accuracy, growing the online vision correction market.

Simon Seshadri, senior vice president of global marketing at CooperVision, describes how the field experienced an increase in online activity with COVID-19. “When they ran out of lenses, consumers went looking for other options. The online sellers were highly active during that time in gaining new clientele.”

|

| Fig. 1. Online eye care retailers, such as 1-800-CONTACTS (top) and Warby Parker (bottom), benefited from remote glasses prescription renewal services during the COVID-19 shutdown. Click image to enlarge. |

For the practices set up for online sales, Mr. Seshadri said that their contact lens sales provided some of their only revenue in the absence of eyeglass sales. CooperVision worked with offices to direct-ship contact lenses to patients. One of the biggest changes the company noted was a decrease in annual supply sales of disposable contact lenses with more consumers purchasing smaller quantities of lenses, likely due to economic anxiety, adds Mr. Seshadri.

At the height of COVID-19 closures, Aaron See, senior vice president of manufacturer partnerships at ABB Optical Group, said the company experienced the most dramatic drop in ophthalmic and specialty contact lens sales, with a more modest decline in disposable soft contact lens sales. As practices reopened, these sales began to rebound, and by June 2020, ophthalmic and specialty contact lens sales had already reached pre-COVID-19 levels, noted Mr. See.

According to Mr. See, ABB Optical’s patient-facing website helped propel almost a 300% increase in online ordering through independent eye care practitioners during the closures. Direct delivery to patients still operates at around 50% growth, Mr. See reports, suggesting a more lasting change. Contact lens subscriptions have also increased, added Mr. See.

|

| Fig. 2. GlassesUSA offers a scanner app to help customers renew their prescription. Click image to enlarge. |

|

| Fig. 3. Before their appointment, patients have their forehead temperature taken. Click image to enlarge. |

The shift to online prescription renewals and eyewear and contact lens purchases seems natural under the circumstances, which explains the increasing popularity of this channel.

In-office Adaptations

Practicing optometry is more demanding now. From an operational standpoint, most practices are asking pre-appointment screening questions to affirm that patients do not have symptoms of COVID-19 and have not been around anyone who is being tested or has tested positive for the virus.2 They are also taking forehead temperatures upon arrival (Figure 3).2 Most practices have fewer available appointment slots, with 26.8 patients seen per day before COVID-19 and 21.6 patients seen per day as offices reopened, a 19.4% reduction in volume.2 Almost all practices have placed more emphasis on hygiene and protective equipment (Figures 4 and 5).2 About one-third of practices have had difficulty getting former employees to return to work.2

For all these reasons, optometrists who practice in-office have felt like they are at a disadvantage when compared with their online counterparts. “There is an unfair playing field because independent optometrists have to buy protective equipment and disinfecting supplies, see fewer patients and continue managing the costs of maintaining a physical location, while online retailers avoid many of these costs because they don’t physically interact with the patient,” notes Albert Chang, OD, co-owner of Family EyeCare Center in Campbell, CA.

|

| Fig. 4. Shields between staff and patients serve as protective barriers. Click image to enlarge. |

With additional operational costs and reduced appointment availability, patients who no-show, cancel or reschedule at the last minute are even costlier. Some practices now require patients to make a deposit to book an appointment. Others are preferentially recalling their most profitable patients and dropping low-paying vision plans to maximize profitability.

Mr. Seshadri emphasizes the importance of bringing in revenue from services as well as products. “The other sales channels cannot compete in the professional services realm, so build a wall of defense around your practice with your service offerings because that cannot be as easily commoditized.”

Jim Thimons, OD, medical director and founding partner of Ophthalmic Consultants of Connecticut, explains that vertical expansion of services is another needed adjunct to day-to-day disease management for increased profitability. Employing fee-for-service technology, such as the burgeoning field of in-office eyelid treatments for meibomian gland expression, is a great way to accomplish both goals simultaneously, he said. With these systems, “you can augment your medical care services to an existing patient base and create new fee-for-service revenue while improving the overall quality of care for your patients.”

There is an economic advantage to providing higher-revenue products and specialized services while also limiting face-to-face interaction when possible and promoting convenience. This includes medical services, low vision, vision therapy, specialty contact lenses and myopia management.

“When you rely on the sale of goods that are common and undifferentiated, it is difficult to be unique,” Dr. Thimons says. “On the other hand, expanding the breadth of care across the ocular disease space is a great way to increase patient services and at the same time develop additional recurrent sources of revenue that are not reliant on optical good sales.”

Five Reasons to Partner with Private Equity: One OD's PerspectiveBy Russell Beach, OD 1. Value Valuations are at historic highs. Private equity has driven some practice valuations—a multiple of earnings before interest, tax, depreciation and amortization—beyond what practices could have ever realized on their previous trajectories. Even during the COVID-19 pandemic, many groups are giving valuations based on pre-COVID earnings and holding a small portion of the closing proceeds as an “earnout,” which will be realized once a practice hits a revenue target equal to their pre-COVID earnings. This is great for practices that paused services or are running at half capacity—as long as the practice does, in fact, bounce back. Practices are more attractive during a healthy growth phase. Peak earning years are when a practice has several years of impressive revenue growth with a strong potential for future growth. Many consolidators are willing to pay a higher multiple for that type of practice than one with flat or declining revenue. If a practice owner waits until the practice’s growth slope flattens, the opportunity for a peak valuation multiple has passed. Equity growth is key. Some groups allow selling optometrists to convert a portion of their proceeds into equity shares in the consolidator. Optometrists who can take an equity position early in the life cycle of a consolidator could have a high potential return on investment if the practice succeeds. Of course, practice owners who remain invested after consolidation retain some risk in doing so; if the practice struggles, so does the investment. 2. Risk Reduction Depending on the fine print of the deal, fully transitioning ownership could reduce the risk to an OD’s personal wealth. The later years of a career are secured by employment with a larger entity, and the practive owner has additional resources to invest elsewhere, such as for family and retirement planning. However, practice owners have to be careful that the partnership does not include conditions that increase risk. For example, practice owners could still be liable if personal guarantees, such as real estate and vendor accounts, remain in their name. 3. Work-Life Balance Of course, not all consolidating groups are created equal and optometrists interested in selling must do their research. Some may require partner ODs maintain operational involvement, for example. The goal is to partner with a group that fosters a work climate that aligns with the aspirations of the selling optometrist. 4. Refocus on Patient Care Skills Partnering with private equity can allow someone else to assume administrative duties and provide the OD time to keep up with continuing education and learn about new equipment or procedures. 5. Develop Outside Interests Partnering with private equity-backed groups may not be the best decision for every optometrist. However, these practice ownership transitions and partnerships can allow for significant financial, professional and personal value. Rather than an exit strategy, the greatest opportunity may exist in peak earning years. Dr. Beach is a co-owner of Coastal Vision in Virginia. His practice partnered with Keplr Vision in August 2020. He can be contacted at drbeach@coastalvisionva.com. |

Telemedicine Services

In an interesting twist, despite optometric proponents denouncing remote eye care in years previous due to threats of online refraction, the profession has seemingly had a change in heart.

“COVID-19 has made it apparent that optometry needs to acknowledge that online eye care is here to stay and that telemedicine has become an accepted technology and will maintain a presence going forward,” notes Dr. Thimons.

Telemedicine refers to a diverse range of health technologies used at a distance. In the past, telemedicine was attractive because it improved access to care in rural areas. Today, the motivation is physical distancing to reduce contagion.

One of the simplest, but not necessarily obvious, forms of telemedicine is the phone. Most doctors have unknowingly offered telemedicine by conducting consults this way. However, we tend to pay more attention to video chat and flashier technologies. Mr. See believes that platforms such as Eyecare Live and others maintain the doctor-patient relationship, provide patients with increased access to varied methods of care, augment a doctor’s presence, help triage patients and reduce the number of in-office visits during a time in which patients may hesitate to visit a doctor’s office.

While these technologies enable doctors to diagnose and treat low-stakes conditions, such as allergic conjunctivitis, hordeola and blepharitis, our initial collective experience is tempered by the reality that telemedicine is more adjunctive than substitutive. Accordingly, in May 2020, 90% of optometrists indicated plans to integrate telemedicine into their practice on a regular basis, but by July 2020, that number had dropped to about 60%.2

Dr. Thimons’s was one of the many practices that offered telemedicine during the shutdown. He says patients accepted and readily adapted to this avenue, which could introduce a shift in the field and impact the direction optometry moves in. For nearly two months, he handled up to 20 telemedicine consults per day. As practitioners returned to their offices and patients began leaving their homes, however, he went from all of his appointments being remote to only 10% to 15%.

Dr. Thimons says that while telemedicine has a place within optometry, its ongoing role will depend on several factors. “The big issue in its success is whether the reimbursement of virtual care will continue to compare with office revenues from direct patient encounters.”

This is not the only implication with telemedicine. It could inadvertently open the door for direct-to-consumer remote online refraction technologies, some of which skirt the best interests of patients just to sell product. Telemedicine could also silo patient health information between different information systems, potentially creating a data entry burden, especially if these systems do not talk to one another.

Private Equity Acquisitions

Recent years have seen a flurry of interest in eye care practice acquisition from the investment community. Ophthalmology practices, and their enviable cash flows, were the first target; then, investors saw the value of optometry as the gatekeepers of eye care. But, as it has with so much else, the pandemic tamped down private equity activity.

David Sheffer, chief growth officer at MyEyeDr., reports that in April and May 2020, the company’s network largely shut down and refocused on establishing safety protocols, obtaining personal protective equipment and redoing scheduling templates. The company re-opened in waves of about 100 practices and is now fully operational.

|

| Fig. 5. Extra hygiene measures are taken to prevent the spread of illness. Click image to enlarge. |

“Our acquisitions were paused from March onward,” Mr. Sheffer says. Acquisitions were also paused, even for those with letters of intent, “but we are still honoring the purchase prices with demonstrated business recovery.” The company planned to start closing acquisitions at the end of the summer and intends to acquire more than 100 practices before the end of 2020.

Mr. Sheffer names two key implications for consolidation due to COVID-19. “First, there will be a significant flight by buyers to quality practices. MyEyeDr. was always picky with the type of practice, quality of doctor and financials, but now we are even pickier. Second, our practices need to get creative because we cannot see as many patients per day. To increase capacity, options can include adding evening or weekend availability.” He adds that this period of uncertainty demonstrates that none of us are in complete control, which may give some doctors more reason to sell to reduce their business risk.

James Wachter, OD, chief professional officer and co-chairman of Eyecare Partners, says the company is still moving forward with acquisitions and offering valuations similar to the company’s pre-COVID-19 offers. He notes that, in some cases, letters of intent may provide the company some protection for practices that do not fully recover.

“COVID-19 may not go away any time soon, so there may be some retraction of aggressive acquisitions across the board,” Dr. Wachter says. “The deal structures and evaluations may change, but the consolidation players will be here for the long-term.”

Claude Labeeuw, chief growth officer of Keplr Vision Services, says that the company has regained operational footing and resumed acquisitions with valuations based on pre-COVID-19 numbers for practices able to return to their historical level of business. “More than ever, we are focusing on acquiring quality, well-run practices that have recovered quickly from closure,” he says. “We seek practices with the right culture, mindset and infrastructure.”

A Brighter Road Ahead

This new era has raised more questions than it has answered. Still, there are a few things we can all be doing.

“In moving from emergency to recovery, success depends on how we reframe business,” Mr. Seshadri says. “Post-COVID-19 does not need to be worse, but it can be different.”

COVID-19 highlighted the vulnerability of the optical element of the profession, according to Dr. Thimons. “During the shutdown, the interface to patients was driven by online medical care and embraced by clinicians throughout the country. As a profession, I believe that the natural evolution of optometry is to become the ‘internal medicine’ of eye care, interfacing with the larger medical community in a more substantive way.”

Charissa Lee, OD, head of North America professional affairs at Johnson & Johnson Vision Care, says, “COVID-19 has forced all of us to evaluate our priorities and compelled us to look at different ways of operating. The silver lining may be that it has propelled us to form new ideas and search for unique solutions that will continue to best serve our patients and the optometric industry.”

From the hardship of COVID-19 comes new opportunities. Even if vaccines with durable immunity are forthcoming, the reality is that this virus may be with us for decades to come. Plan accordingly, keeping these new opportunities in mind.

Dr. Chou practices in San Diego at ReVision Optometry, a referral-based keratoconus and scleral lens clinic.

1. PR Newswire. KKR to acquire DTC pioneer 1-800 contacts from AEA investors. www.prnewswire.com/news-releases/kkr-to-acquire-dtc-pioneer-1-800-contacts-from-aea-investors-301136355.html. Published September 23, 2020. Accessed October 1, 2020. 2. Jobson Optical Research. Coronavirus ECP study. www.reviewob.com/download/36165/. Accessed October 1, 2020. |